The battle lines are being drawn over the TPP and

TPA. If you are confused, well, that is exactly what many of the most powerful

corporations in the U.S.,

and around the world, are counting on. Trade policy is arcane, complex and long

the domain of economists and technocrats. But the real-world implications of

these dry texts are profound. President Obama wants to pass the TPP, which is a

broad trade agreement between the U.S.

and 11 other countries in the Pacific Rim: Australia,

Brunei, Canada,

Chile, Japan,

Malaysia, Mexico,

New Zealand, Peru,

Singapore and Vietnam.

In order to expedite the process, President Obama is seeking the second

acronym, TPA, or Trade Promotion Authority, also called “fast-track.” Fast-track

gives the president authority to negotiate a trade deal, and to then present it

to Congress for a yes-or-no vote, with no amendments allowed. A growing

coalition is organizing to oppose TPP and the president’s request for

fast-track. The outcome of this conflict will reverberate globally for

generations to come.

The TPP negotiations have been held in secret.

Most people know what little they do because WikiLeaks, the document disclosure

and whistle-blower website, released several chapters more than a year ago.

Members of Congress also have been given limited access to briefings on the

negotiations, but under strict secrecy rules that, in at least one instance

recently, include the threat of imprisonment if details leak.

The TPP would be an expanded version of earlier

trade agreements, like NAFTA, the North American Free Trade Agreement,

involving the U.S.,

Canada and Mexico.

NAFTA went into effect on Jan. 1, 1994,

and was so harmful to the culture and economy of the indigenous people of Chiapas,

Mexico, that they

rebelled on that very day, in what is known as the Zapatista Uprising. Attempts

to create a global trade deal, under the auspices of the World Trade

Organization, provoked one of the largest protests against corporate power in

history, in Seattle in late 1999.

Thousands of protesters locked arms and literally blocked delegates from

getting to the ministerial meeting. As unexpected solidarity between union

members and environmentalists flourished in the streets, despite widespread

police violence, the WTO talks collapsed in total failure.

The TPP, if passed, would implement trade rules

that make it illegal for governments to create and enforce regulations on

everything from environmental standards, to wage and labor laws, to the

duration of copyrights. A law prohibiting the sale of goods made in sweatshops

in Vietnam

could be ruled illegal, for example, as a barrier to trade. Or certification

requirements that lumber not be harvested from old-growth forests in Malaysia

could be overturned.

Lori Wallach of Public Citizen’s Global Trade

Watch program is one of the leading critics of TPP:

“It’s a delivery mechanism for a lot of the

things [Senate Majority Leader Mitch] McConnell and the Republicans like. So,

for instance, it would increase the duration of patents for Big Pharma and, as

a result, give them windfall profits but increase our medicine prices. It could

roll back financial regulation on big banks. It could limit Internet freedom,

sort of sneak through the back door the Stop Online Piracy Act, SOPA,” Wallach

explained. “It would give special privileges and rights for foreign

corporations to skirt around our courts and sue the U.S.

government to raid our treasury over any environmental, consumer health law

that they think undermine their expected future profits, the so-called

‘investor-state’ enforcement system. Plus, it would have the NAFTA-style rules

that make it easier to offshore jobs, making it easier to relocate to low-wage

countries.”

The TPP, she went on, “was negotiated with the

assistance of 600 corporate advisers, official corporate trade advisers in the U.S.

The agreement has been the initiative of the Obama administration. It was

started by [President George W.] Bush, but instead of turning it around and

making it something different, the Obama folks picked it up and, frankly, have

made it even more extreme.”

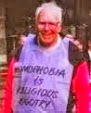

Grass-roots activists are organizing against the

TPP and fast-track. They work on diverse issues ranging from human rights and

Internet freedom to fair trade, labor rights and the environment. The moneyed

interests in Washington have the

ear of the president, so they need only whisper. Now people must raise their

voices, in unison, and demand to be heard.

Denis Moynihan contributed research to this column.

Bio: Amy Goodman is the host of "Democracy Now!,"

a daily international TV/radio news hour airing on more than 900 stations in North

America. She is the author of "Breaking the Sound Barrier,"

recently released in paperback and now a New York Times best-seller.

Don’t Keep the Trans-Pacific Partnership Talks Secret

By MARGOT E. KAMINSKIAPRIL 14, 2015 NEW YORK TIMES

COLUMBUS,

Ohio — WHEN WikiLeaks recently

released

a chapter of the Trans-Pacific Partnership Agreement, critics and proponents of

the deal resumed wrestling over its complicated contents. But a cover page of

the leaked document points to a different problem: It announces that the draft

text is classified by the United States

government. Even if current negotiations over the trade agreement end with no

deal, the draft chapter will still remain classified for four years as national

security information. The initial version of an agreement projected by the

government to affect

millions

of Americans will remain a secret until long after meaningful public debate is

possible.

National security secrecy may be

appropriate to protect us from our enemies; it should not be used to protect

our politicians from us. For an administration that

paints

itself as dedicated to transparency and public input, the insistence on

extensive secrecy in trade is disappointing and disingenuous. And the secrecy

of trade negotiations does not just hide information from the public. It

creates a funnel where powerful interests congregate, absent the checks,

balances and necessary hurdles of the democratic process.

Free-trade agreements are not just about

imports, tariffs or overseas jobs. Agreements bring complex national regulatory

systems together, such as intellectual property law, with implications for free

speech, privacy and public health.

The level of secrecy employed by the

Office of the United States Trade Representative is not typical of how most

international agreements are

negotiated.

It’s not even how our

negotiating

partners say they want to operate. Yet it is the way that the Obama

administration handles trade deals, from a failed

anti-counterfeiting

agreement more than two years ago to the TPP today. The trade

representative’s office keeps trade documents secret as national security

information, claiming that negotiating documents — including work produced by United

States officials — are “foreign government

information.”

The justification for secrecy in trade is

that negotiations are like a poker game: Negotiators don’t want to reveal their

hand too soon, or get pressured by concerned domestic constituencies. But the

trade representative’s office takes this logic too far. After being forced to

turn over documents in a 2002 lawsuit, it began regularly classifying trade

documents. Now the office uses classification to invoke the national security

exemption to open government law. Yale

Law School’s

Media Freedom and Information Access Clinic is challenging this behavior in a

lawsuit. (I submitted

testimony in the case.)

The peculiarity of this secretive

approach is becoming more apparent as our foreign negotiating partners push

toward transparency in trade. The European Union now

voluntarily

releases its side of trade negotiations in an effort to be as transparent

as possible; New Zealand

officials

pressed

for greater transparency in previous trade negotiations with the United

States.

Secrecy has real costs. Because the

negotiating process combines a general shield from the public with privileged

access for industry advisers, the substance of American free trade agreements

does not represent truly national interests. It represents the

interests

of those members of industry who sit on the office’s

Industry

Trade Advisory Committees, which have regular access to negotiating

information.

Recent Comments

fritzrxx

16 hours ago

Eric

16 hours ago

BDR

16 hours ago

One justification for keeping trade

negotiations in the executive branch is that it can keep lobbyists at bay. But

the current system brings those entities inside, using classification to keep

out citizens and competitors. Perhaps in response to these sorts of criticisms

in 2014, the Obama administration

announced

the creation of a new public interest advisory committee. But that committee

would be given less direct access than industry groups, and couldn’t discuss

some issues with the public.

Secrecy also delegitimizes trade

agreements: The process has been internationally criticized as undemocratic.

The European Parliament, for example,

rejected

the Anti-Counterfeiting Trade Agreement in large part over legitimacy concerns.

In some of our trading partner countries, citizens have objected to trade

agreements by calling them undemocratic. And they rightly fear that the

American commitment to these agreements is weak because the United

States public might rebel once the texts are

released.

Congress is soon

likely

to consider whether to authorize an up-or-down vote on a trade deal, with

what’s known as “fast track” legislation. Free trade now involves dozens of

areas with complex subject matter, and the agency responsible for negotiating

it often fails to tap key expertise. The discussion over the trade negotiating

authority is not a question of which is better: the executive branch or the

legislative branch. It’s a question of whose input we’re getting on decisions

that reach far beyond trade — into questions on the price of generic drugs or

whether websites will have to monitor users online.

As it considers fast track here, Congress

must address the secrecy, and the views of the privileged advisers, that shaped

the agreement. Otherwise, “fast” will be little more than a euphemism for

“avoid the public, and benefit the fortunate few.”

Margot

E. Kaminski is an assistant professor of law at Ohio

State University

and a fellow of the Information Society Project at Yale

Law School.

Gold standard trade deal is littered with pitfalls

Date

April 15, 2015 - 12:45AM

the age

Leon Berkelmans

Trade deals were once about securing global trade. So, a shift

towards negotiating issues other than trade is troubling.

Australian Prime Minister Tony Abbott meets with leaders of Trans-Pacific

Partnership Agreement at the US Embassy in Beijing.

In 1983, Australia

and New Zealand

signed a trade agreement. The Australia-New Zealand Closer Economic Relations

Trade Agreement ran to

24

pages. Additional annexes came in at

47

pages. Fast forward to 2004, and Australia

signed a trade agreement with the United States

that came in at

271

pages. I'll leave it to the interested reader to count the annexes, but

Annex 2-B, for the US

only, comes in at

560

pages. You get the idea.

Right now negotiators are sweating over another tome: the

Trans

Pacific Partnership. This is an agreement that covers 12 countries, $28

trillion in gross domestic product, and 800 million people (notably absent from

the agreement is China).

It appears to be continuing the trend towards complexity.

The US takes 80 specialists to each negotiation, Japan 120, and Australia 22.

It is difficult to see documents with 500-page annexes leading to a simple,

open system of world trade.

Clearly, somewhere along the way, we decided that bigger is better. The

Trans Pacific Partnership has been touted as a "gold-standard" trade

agreement. It is apparently going to include provisions on intellectual

property, investor protection, along with ... well, many things, I guess.

Nothing has been made public yet. Nothing will be until it is signed. We won't

know, for example, if there will be provisions on currency manipulation.

This all represents quite a change for Australian trade policy. Once upon a

time, it was all about trade. Negotiating on intellectual property and other

mutations wasn't even contemplated. And when negotiating, it was all about

getting a global deal done. It's time to return to those roots.

Let's start with the shift to bilateralism and regionalism. During the heady

days of the 1980s, we were told that tariffs were generally bad, and free trade

good. It would seem, then, that any agreement that brought tariffs down,

whether it be multilateral or not, would be progress. That's not quite right.

Suppose that we import cars from the US

and China and

each face a tariff of 50 per cent. Now suppose we reduce the tariff on cars

from China.

There is a chance Chinese cars will crowd out US cars, but not actually lead to

a substantial decline in price. If that happens, cars in Australia

do not become much cheaper to buy, and the government misses out on tariff

revenue. This is a well-known problem of trade liberalisation that is not

multilateral. Economists call it trade diversion.

Trade diversion might, in part, be why we do not seem to have experienced

large gains from the trade agreements already negotiated. In fact, the

political process may tilt the field towards trade-diverting agreements. That

was the conclusion of Elhanan Helpman, of Harvard

University, and Gene Grossman, of Princeton

University, in

a

paper they published in the world's top economics journal, the

American

Economic Review. They concluded "trade diversion [of an agreement]

will enhance [its] political viability while contributing to an inefficient

allocation of resources in the two partner countries".

The shift towards issues outside of trade is even more troubling. The

benefits of free trade of goods and services have firm theoretical foundations.

There's a theorem, called the "first fundamental theorem of welfare

economics", that lays out general conditions under which free trade is

efficient. Sounds important, doesn't it? It is.

Unfortunately for the proponents of expanding the scope of trade agreements,

there is no similarly theoretically robust reason why, for example,

intellectual property rules need to be harmonised. In fact, it's the opposite.

In

a

paper written nearly 10 years ago, once again in the

American Economic

Review, Grossman and Edwin Lai, of the Hong Kong University of Science and

Technology, concluded "harmonisation of patent policies is neither necessary

nor sufficient for global efficiency". All harmonisation does is shift

gains from the users of intellectual property to the producers.

Similar concerns pervade the other non-trade aspects of the Trans Pacific

Partnership. Investor-state dispute settlement provisions would allow foreign

investors to sue the Australia government,

even though Australia's

legal system and protections are already strong. This is not the kind of thing

one finds in an economics textbook on market efficiency.

The desire to pursue trade agreements is understandable, given the problems

the World Trade Organisation is having. There are hopes that trade agreements

are a stepping stone to global free trade. It is possible, but difficult to

sustain when looking at the complexity of these agreements. It is difficult

to see documents with 500-page annexes leading to a simple open system

of world trade.

As much as it might be hard to accept, the best course of action might be

just to go back to the World Trade Organisation and focus on trade and our

multilateral tradition. Progress might be slow, but at least when change is

made, it is likely to be beneficial.

Dr Leon

Berkelmans is director, international economy at the Lowy Institute for

international policy.

A Trade Rule that Makes It Illegal to Favor Local Business? Newest Leak

Shows TPP Would Do That And More

The newest leaked text is full of dense legal

jargon. But a close reading makes its corporate agenda crystal clear.

Secret negotiations on the Trans-Pacific

Partnership (TPP), a trade and investment agreement involving 12 nations of the

Pacific Rim, are coming to a close, and President Barack

Obama will soon submit the final agreement to the U.S. Congress for approval.

Here are the Cliffs Notes in simple English.

But a newly leaked document belies those claims.

The Trans-Pacific Partnership’s text consists of a number of chapters, among

the most important of which is the one on investments. On March 25,

WikiLeaks

released a confidential draft of that chapter dated January 20. The draft

contains instructions indicating that it will be declassified only “Four years

from entry into force … or, if no agreement enters into force, four years from

the close of the negotiations.”

A quick reading of the leaked chapter makes it

clear why TPP sponsors have gone to great lengths to keep their negotiations

secret. The document substantiates claims by opponents that the TPP is a

corporate-rights agreement designed to facilitate the export of U.S.

jobs, allow corporations to sue governments for enacting labor and

environmental protections, make it illegal for governments to favor local

businesses, and advance the colonization of national economies by global

corporations and financiers.

As problematic as this chapter is, we can be

thankful that it is out in the open. Now the need is to understand what all the

legalese means.

The leaked document includes many technical

details decipherable only by trade lawyers. Here are the Cliffs Notes in simple

English.

1. Favoring local ownership is

prohibited

Let’s start with the Investment Chapter’s section

on how the TPP’s member countries should treat foreign investors:

Each Party [country] shall accord to investors of

another Party treatment no less favorable than that it accords, in like

circumstances, to its own investors with respect to the establishment,

acquisition, expansion, management, conduct, operation, and sale or other

disposition of investments in its territory.

Put in plain English, the above paragraph means

that signatory countries renounce their right to favor the domestic ownership

and control of the lands, waters, and other productive assets and services

essential to the lives and well-being of their people.

The 12 countries further renounce their right to

favor locally owned businesses, corporations, cooperatives, or public

enterprises devoted to serving their people with good local jobs, products, and

services. They must instead give equal or better treatment to global

corporations that come only to extract profits.

2. Corporations must be paid to

stop polluting

Another provision limits what member countries

can do in regard to corporate investments:

No Party may expropriate or nationalize a covered

investment either directly or indirectly through measures equivalent to

expropriation or nationalization (“expropriation”), except: (a) for a public

purpose; (b) in a nondiscriminatory manner; (c) on payment of prompt,

adequate, and effective compensation [emphasis added] … ; and (d) in

accordance with due process of law.

This provision may sound reasonable, until you

look at the chapter’s definition of “investment,” which includes “the

expectation of gain or profit.” This odd definition means that a corporation

can sue a signatory nation if the country deprives the corporation of expected

profits by enacting laws that prohibit the company from selling harmful

products, damaging the environment, or exploiting workers. Other language in

the chapter makes it clear that this applies to actions at all levels of

government.

In other words, a country in the TPP has every

right to stop a foreign corporation from harming its people and the

environment—but only if the country compensates the corporation for the expense

of not harming them.

Foreign firms have won more than $360 million in

taxpayer dollars thus far in investor-state cases brought under NAFTA. Of the

11 claims currently pending under NAFTA, demanding a total of more than $12.4

billion, all relate to environmental, energy, land use, financial, public

health and transportation policies—not traditional trade issues.

3. Three lawyers will decide

who’s right in secret tribunals

The leaked chapter also describes how

disagreements will be settled:

Unless the disputing parties otherwise agree, the

tribunal shall comprise three arbitrators, one arbitrator appointed by each of

the disputing parties and the third, who shall be the presiding arbitrator,

appointed by agreement of the disputing parties.

The arbitrators are private lawyers who are not

accountable to any electorate. They are empowered by the TPP to order unlimited

public compensation to aggrieved investors. The proceedings and the identities

of the tribunal members are secret, and the resulting decisions are not subject

to review by any national judicial system.

According to

The New York Times, NAFTA

tribunals, on which the ones in the TPP are modeled,

even

have the power to overturn judgments of national courts—including the U.S.

Supreme Court. John D. Echeverria, a law professor at Georgetown

University, has called this method

of dispute settlement “the biggest threat to United

States judicial independence that no one has

heard of and even fewer people understand.”

4. Speculative money must remain

free

Yet another provision prohibits restrictions on

movement of money from one country to another:

Each Party shall permit all transfers relating to

a covered investment to be made freely and without delay into and out of its

territory. …

Forms an investment may take include: (a) an

enterprise; (b) shares, stock, and other forms of equity participation in an

enterprise; (c) bonds, debentures, other debt instruments, and loans; (d)

futures, options, and other derivatives.

Thus, the TPP guarantees the right of speculators

to destabilize national economies through the manipulation of exchange rates

and financial markets, without interference from national governments.

In so doing, the TPP strips national governments

of the right to limit speculation in favor of investment in strong, stable, and

productive national economies.

5. Corporate interests come

before national ones

Another passage assures that corporations need

bear no obligation to serve the interest of the people who live in the

countries where they do business:

No Party may … impose or enforce any requirement

or enforce any commitment or undertaking: (a) to export a given level or

percentage of goods or services; (b) to achieve a given level or percentage of

domestic content; (c) to purchase, use or accord a preference to goods produced

in its territory, or to purchase goods from persons in its territory.

The article continues on with six additional

provisions, which together prohibit governments from requiring that a foreign

investor be under any obligation to serve the host country’s people or national

interest.

The 12 countries would renounce their right to

favor locally owned businesses

Obama administration officials say these

provisions are needed to level the playing field for American companies doing

business abroad. This raises an important question: What is an American

company?

The Institute for Policy Studies

reports

that U.S.

corporations and their subsidiaries currently hold $2.1 trillion in profits

offshore to avoid paying taxes to the government of the United

States. These include highly profitable

companies like Microsoft, Google, Apple, General Electric, Exxon Mobil, and

Chevron. One wonders on what basis we should consider these globe-spanning,

tax-dodging, job-exporting corporations to be American.

Approval of the TPP means sacrificing our

democracy and our right to manage our markets and resources for the public

good. And for what gain? To secure rights for corporations—which claim an

American identity only when convenient—to exploit the peoples and resources of

other countries that have signed the same nefarious agreement.

Bio: David Korten is co-founder and board chair of YES!

Magazine, co-chair of the New Economy Working Group, president of the Living

Economies Forum, an associate fellow of the Institute for Policy Studies, and a

member of the Club of Rome. His books include the international best-seller

When Corporations Rule the World, which will be released in an updated 20th

anniversary edition in June 2015.

Related posts

Obama and Republicans Agree on the Trans-Pacific Partnership …

Unfortunately

APRIL 22,

2015 New York Times

There’s an important issue out there you

may never have heard of, which is just what its proponents would like. That’s

the Trans-Pacific Partnership (TPP), currently being pushed by the Obama

administration and its corporate (and mostly Republican!) allies. It’s a

blatant attack on labor, farmers,

food safety, public health and

even national sovereignty.

And the details of the deal are largely

secret. Other

than

what’s been leaked, the public has no access to its contents, and even

members of Congress don’t know much. (On the other hand, “cleared advisers,”

mostly corporate lawyers, have full access.) That’s because the TPP is way too

important to its sponsors to allow little details like congressional or public

input to get in its way, even though constitutional authority over trade is

granted to the legislative, not the executive, branch.

Nutrition, agriculture and health policy.

This is a bipartisan effort if ever there

was one;

George

Will has called the TPP “Obama’s best idea.” Thus we see the

administration, along with pro-business Democrats and Republicans, trying to

bulletproof the deal. Last week, a bill was introduced that would give the

president “fast-track authority” on the TPP. If that passes, Congress could

vote only up or down on the deal, not amend it. That’s quite a bit of

presidential power for a scheme that would have a striking impact on the global

economy — and the food on our table.

The TPP is little more than enhanced

corporation power branded as free trade. It gives corporations the right to

challenge government regulations and seek compensation if they think they’ve

been treated unfairly by any of the 12 Pacific Rim

nations in the deal. (China

is currently, but not necessarily permanently, excluded; part of the thinking

behind the TPP is to lock up an agreement with these partners before China

does.)

Even if you look “only” at food and the

environment, the TPP should be ripped apart and put back together with public

and congressional input. The pact would threaten local food, diminish labeling

laws, likely keep environmentally destructive industrial meat production high

(despite the fact that as a nation we’re eating less meat) and probably

maintain high yields of commodity crops while causing price cuts.

It would certainly weaken food safety.

For example, more than 90 percent of our seafood is imported, a figure that

includes fish that were caught domestically and sent overseas for processing

before coming back in, which makes the inspection process

even

more complicated. All told, that’s more than five billion pounds of imports

annually, and according to the Center for Food Safety, just

90

federal inspectors guarantee its safety. (The Food and Drug Administration

inspects less than 2 percent of imported seafood.) By reducing restrictions on

Southeast Asian imports, the TPP would allow more fish containing chemicals

that are illegal in domestic aquaculture to reach our shores; by making

inspections less effective, it would virtually guarantee that those chemicals

make it to our tables.

The agreement would even allow countries

to challenge one another’s laws, so that “equivalency” may simply mean that the

least powerful regulations become the norm. The United

States would have no special standing: If

our laws are seen as restraining trade or limiting profits, they

could

be challenged in special courts, per the TPP’s “investor state” clause.

Philip Morris is suing

Uruguay over that country’s antismoking laws under just such circumstances;

there are

several

examples of American companies’ flouting local laws and citing trade

agreements as an excuse; and Mexico has been sued repeatedly for theoretically

diminishing investor profits.

When individual governments have little

say, corporate “efficiency” amounts to the global economy’s being run as an

ill-regulated business model (an equally egregious trans-Atlantic agreement is

currently being negotiated). The projected benefits to the public – as usual,

“job creation” leads the list — are mythical, and

you

don’t have to take my word for it.

Historically, trade laws were geared to

enrich the “mother” country — look at the 19th-century Opium Wars in China,

which forced open illegal markets so Britain

and its allies could benefit. Between World War II and the 1990s, free trade

arguably benefited the economies of the countries involved. But the new laws,

starting with 1994’s North American Free Trade Agreement (Nafta), recognized

that capital is now mobile — it doesn’t “live” anywhere — and owes no

allegiance to any flag; only shareholders matter.

Nafta is the paradigm of what are most

accurately called deregulation deals. It promised better jobs in both the United

States and Mexico.

Instead, as well-paid workers in the United

States were losing jobs to worse-paid

workers in Mexico,

badly paid Mexican workers were losing jobs to worse-paid workers in China,

which in turn put more pressure on workers in the United

States.

In fact, if you wanted to single out a

culprit for income stagnation and the decline of the power of labor in the United

States, Nafta would be a good candidate. It

allowed large corporations to move where tax breaks were best and environmental

regulations weakest, while forcing labor to compete against lower global wages.

While likely not the only cause, since its passage

collective and

individual gains have been nearly frozen in Mexico;

in the United States,

the story is much the same.

The situation may be most dire for

Mexican farmers. Millions have been displaced, many emigrating north for menial

jobs. Meanwhile, imports of American corn (a basic staple in the form of

tortillas for 5,000 years),

increased

fourfold. Imports of wheat, rice, cotton and soybeans have increased

similarly. In brief, Mexican farmers have gone to work for transnational

companies, whether in Mexico,

the United States

or elsewhere. Nor did this do much good for farmers to the north, who have seen

corn prices fluctuate wildly, leaving them to scramble to maximize yields,

which in turn causes environmental damage.

Former Labor Secretary Robert Reich

called the TPP “

Nafta

on steroids” (“

corporate coup

d’état” is also good). As the economist

Dean

Baker said to Bill Moyers, “This really is a deal that’s being negotiated

by corporations for corporations, and any benefit it provides to the bulk of

the population of this country will be purely incidental.” At this point,

nothing about Obama should surprise us, but it’s worth noting that in 2008, as

a presidential candidate, he said, “I voted against Cafta, never supported

Nafta, and will not support Nafta-style trade agreements in the future.”

Recent Comments

JoMo

28 minutes ago

Daniel A. Greenbum

28 minutes ago

Lorraine R

28 minutes ago

All of which is making for some very odd

alliances and demonstrating that “far right” and “far left” labels are

increasingly useless. That’s because this is a struggle between transnational

corporations and just about everyone else.

Of course, some Republican opposition

could be crafty positioning, so that when the TPP is found to cost jobs and

endanger public health rather than create them and assure it, cynics could

simply say, “I told you so.” But in this case Obama has asked for the bad

publicity. And although Hillary Clinton’s husband was the architect of this

kind of policy, and she worked hard for the TPP while secretary of state, she’s

now

backing away from what may well be a losing proposition.

That’s the good news: The opposition to

fast-tracking appears strong. As Patrick Woodall, a senior policy advocate for

Food & Water Watch, said to me, “The forces pushing fast-track are huge,

but there is unbelievable public opposition, and at this point the wind is at

our back.”

There

is such a thing as a

good trade

agreement, though it’s barely conceivable that Obama and Congress could

negotiate one. We could imagine, for example, something that did away with tax

havens for corporate profits. (For a

detailed

analysis of this, see this paper from the Economic Policy Institute.)

But even to have a shot, fast-track must

be defeated, and a solid debate must be opened among well-informed

representatives, with plenty of public input. More exploitation of labor, fewer

public health regulations, more facile production of useless goods and bad food

— that is not the direction the global economy needs to go.